My service has been purchased by Trade Genius, and we will continue the adventure from there. www.tradegenius.co

All the great signals as before, and with more to come. Stay tuned. Bob

Wednesday, April 27, 2016

Saturday, March 26, 2016

It Begins

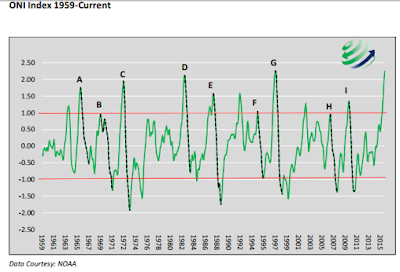

El Nino is rapidly turning into La Nina, and it will affect grain prices. Usually we see prices move closer to June, but the weather is already setting up. Next week a Polar Vortex is rolling through the Midwest, and Canada, and Canada is already reporting a significantly reduced crop and with a warm February/March the wheat crop is sprouting. A freeze will be devastating.

http://www.accuweather.com/en/weather-news/fresh-round-cold-snow-rain-unsettled-weather-west/56286017

http://www.agweb.com/article/canada-reduces-wheat-output-forecast-as-weather-hurts-crops/

http://www.accuweather.com/en/weather-news/fresh-round-cold-snow-rain-unsettled-weather-west/56286017

http://www.agweb.com/article/canada-reduces-wheat-output-forecast-as-weather-hurts-crops/

Sunday, March 20, 2016

Where now?

We have just had one of the most epic short squeezes in market history. Every tool was used to lift the market;

- Shorts were squeezed relentlessly

- Volatility was sold (biggest squeeze in years)

- Bonds were sold (auction failures hit records)

- Commodities were lifted (relieving banks from defaults)

- Europe went negative and will now buy corporate bonds

- China is now 250% debt to GDP

- The U.S. bailed on rising rates

- Companies bought billions in stock repurchases.

- No new issues brought to the market

What did it accomplish? Inflation rate nominally positive, and stock prices flat for the year. They woke up gold, silver, and food. Companies are borrowing in excess of earnings just to reduce their share count and create an appearance of growth in EPS. Federal Reserve is the only other buyer lifting the market.

So what? One of two things Will happen. The Fed's will crank out inflation, but the wrong kind, the one that acts like a tax; food and energy, and we will recreate 2008 and 2011 events, or we just roll over as this is all the market can handle.

For me I think food prices will be the killer of this whole experiment, and will begin with the first crop deficiency reports. La Nina is proceeding apace, sugar and coffee are following the script. By June we will see corn, soybeans, and wheat lift. But the prices will rise farther than expected for the seasonal trade. China cannot absorb the price increases as food is already trending higher with Jan/Feb up 8%. I am pretty sure wages are not following that script. There goes their little experiment in currency devaluation. I am pounding on this as no one is looking here, yet prices are lifting.

For next week, we are seasonally weak, and buybacks are in blackout. Plus we just squeezed the wedge and closed a gap. Risk reward supports going short. I have VXX, with my DBA, and JJG. We also should see a let down in oil on a sell the news from the summit of the OPEC thieves. Over $40 brings U.S. production back online. Good luck continuing that ramp.

Good trading this week.

Friday, March 18, 2016

Rocks, Paper, Scissors

Food and energy trumps the Fed. Be careful what you wish for Central Bankers of the world. You have created an environment and put yourself into a very weak position. Climate is changing from warm to cold in the Pacific (El Nino to La Nina) and the last two times that has happened, 2007-2008, 2010-2011 we had some nasty sell offs. This time though, the world's population is even less able to absorb the twin shocks of higher energy and food.

The canary in the cola mine is sugar, coffee and Cocoa. They all started to move already. I posted these charts before (Scroll down). They are on long term buys. Next is cotton, and it is awakening. Then the grains by summer.

The squeeze on budgets and company margins will be fierce, and this time the Fed has no room to stop the inflation because everyone's debt is so high.

I will profit from this as I am already prepared, but I won't be happy about it. You have been so thoroughly duped and so many will suffer for the sake of the privileged.

The canary in the cola mine is sugar, coffee and Cocoa. They all started to move already. I posted these charts before (Scroll down). They are on long term buys. Next is cotton, and it is awakening. Then the grains by summer.

The squeeze on budgets and company margins will be fierce, and this time the Fed has no room to stop the inflation because everyone's debt is so high.

I will profit from this as I am already prepared, but I won't be happy about it. You have been so thoroughly duped and so many will suffer for the sake of the privileged.

Wednesday, March 16, 2016

Sunday, March 13, 2016

Ag Commodity Update

Enjoy, CORN and SOYB have not made a higher high yet, so not yet charting buy/Sell signals. This is where the long action will be this year. 50% plus return on all of these highly likely. Swing trades, so hold for weeks at a time. Subscribe and you will get them real time.

Thursday, March 10, 2016

The Last Hurrah is Upon Us

We are through this downtrend line. Now we have the top of the value range, and a double top. Then, likely AMF. Everybody was bearish into today, but my signal flashed long for LABU (via BIS puts), FAS, XIV, and SPY (via calls). We are having a killer year. All signals posted real time, with stops given and updated. I priced it for anyone to afford.

Enjoy the trading day.

Enjoy the trading day.

Wednesday, March 9, 2016

Ready for the Summit

Yesterday we rejected the downtrend line, and sold off. It found support and overnight began another attempt at the line. The market likes to move through its value area, especially if it moves back into that range from either end. The top of the range is in the 2046 area, and the odds are 80%. Knowing that China, and the U.S. are providing credit, and dollars, I'll take those odds.

I bought calls yesterday for next Friday, and will likely go long Biotech, and short volatility, as well. A break below yesterday's low will have me re think my plan.

Good trading all.

I bought calls yesterday for next Friday, and will likely go long Biotech, and short volatility, as well. A break below yesterday's low will have me re think my plan.

Good trading all.

Tuesday, March 8, 2016

Sunday, March 6, 2016

Dance with the One Who Brought You

OK, we are hitting resistance, and the one's who can move the market did so by shorting Vol and bonds, and buying the most shorted. We need a break, and this week, is usually the week to get short, and I did with VXX, and SPY puts. I will close them both at some point this week ahead of the FED and maybe the ECB.

But into more interesting developments. The El Nino to La Nina is acting as it should be and that is pushing up the Ag Commodities. So far SGG, NIB, and now JO are on my Weekly time frame buy list (I am holding DBA, which had a nice move this week, as well). If we proceed as expected, BAL, WEAT, CORN, and SOYB will follow (there was signs of life on the hourly charts). If you want to make money (20-50% next 12 months) but don't want to trade too much these are your cats. I will post buy and stops on all of these, for my subscribers, at the ridiculously expensive $12.50/month.

Finally, my performance metrics. I have been steadily killing it all year, then three weeks ago, my father past away, and instead of shutting it down, I traded distracted and off of the signal that works. I tell you this not for sympathy, but as a cautionary tale. Unless you are locked in, don't trade, or suggest trades. The good news after two weeks of travel and family obligations I got back on track and had another nice week, and still beating the broad market with little drama.

Have a great trading week, and sign up if you want to make money and stay ahead of the trends.

But into more interesting developments. The El Nino to La Nina is acting as it should be and that is pushing up the Ag Commodities. So far SGG, NIB, and now JO are on my Weekly time frame buy list (I am holding DBA, which had a nice move this week, as well). If we proceed as expected, BAL, WEAT, CORN, and SOYB will follow (there was signs of life on the hourly charts). If you want to make money (20-50% next 12 months) but don't want to trade too much these are your cats. I will post buy and stops on all of these, for my subscribers, at the ridiculously expensive $12.50/month.

Finally, my performance metrics. I have been steadily killing it all year, then three weeks ago, my father past away, and instead of shutting it down, I traded distracted and off of the signal that works. I tell you this not for sympathy, but as a cautionary tale. Unless you are locked in, don't trade, or suggest trades. The good news after two weeks of travel and family obligations I got back on track and had another nice week, and still beating the broad market with little drama.

Have a great trading week, and sign up if you want to make money and stay ahead of the trends.

Friday, March 4, 2016

Wednesday, March 2, 2016

Biotech is Ready to Break Out Again

OK, Biotech is on the verge of a 10% move. We just created a higher high, and now we are ready to assault the $300 range again. There are three ways to play it. Buy LABU, IBB, or short BIS.

Tuesday, March 1, 2016

Food is Starting to Move

We are having an incredible reversal from the positive ENSO phase to the Negative. (El Nino-LaNina). This is very trade-able. Food prices move up shrplt as the agricultural belts are negatively affected. We will see prices move across all of the trade-able food commodities starting now through next spring.

The first two that are moving, that have ETF's are sugar and cocoa. Sugar displays a nice higher low, and cocoa has a nice double bottom. My momentum signal confirms these technicals.

As I think this will be very profitable area to trade, I am going to follow;

The first two that are moving, that have ETF's are sugar and cocoa. Sugar displays a nice higher low, and cocoa has a nice double bottom. My momentum signal confirms these technicals.

As I think this will be very profitable area to trade, I am going to follow;

- SGG

- JO

- WEAT

- SOYB

- CORN

- DBA

- NIB

I am going to report on a weekly signal, these will be swing trades, and I expect the signal to make us minimum 50% returns. If you want the signals I am adding them to my normal hourly based trade signals. If you already subscribe, a bonus, if not the best ROI on $12.50/month you will ever make.

Sunday, February 28, 2016

Mortality

Two weeks ago, my father passed away. When these things happen, you start to think about your remaining time and what that means for you, your family, your impact, and what the world will look like at your end.

As I reflect on these things, I started looking at other patterns coming to conclusion over these next 25 years, and how do I prepare myself, family, friends, and anyone else who will listen. The patterns are large, and the impacts are huge, and in 17 years of trading I noticed one thing; negative events occur quickly, capturing the unaware, unbelieving, and unprepared off guard.

We have four of them staring us in the face, and they are all interelated, or the impacts will be,

As I reflect on these things, I started looking at other patterns coming to conclusion over these next 25 years, and how do I prepare myself, family, friends, and anyone else who will listen. The patterns are large, and the impacts are huge, and in 17 years of trading I noticed one thing; negative events occur quickly, capturing the unaware, unbelieving, and unprepared off guard.

We have four of them staring us in the face, and they are all interelated, or the impacts will be,

- Worldwide demographic time bomb/Mass Migration. The wealthy, productive societies are rapidly aging, and the less productive and poor are not. This is a triple whammy for Europe, a double whammy for the U.S. and a Whammy for North/NorthEast Asia. Europe will not be able to care for their elderly, at the same time they are importing people who can offer nothing, yet need government resources to survive, and are bringing a culture that is foreign and hostile to everything Europe holds dear. The U.S. suffers from the first two, and Asia will suffer the burden of caring for their elderly. In fact the next two patterns will make this problem incredibly painful, and incendiary.

- Worldwide climate cold phase pattern aligning. There are eight climate influencers, and every two hundred tears, they all align in the negative phase. When that happens, worldwide growing seasons shrink by 15%, and agriculture production above the 45 Laditude cease for 10-15 years. The rest of the world sees incredibly wild swings of drought, flood, heat, and cold. These patterns are :

- ENSO/SOI (El Nino/La Nina)

- Atlantic MultiDecadalOscillator

- Arctic Oscillator

- Pacific DecadalOscillator

- Solar Minimums

- Grand Solar Minimums

- Lunar Standstill

- Landscheit Cycle

- Peak credit. At the same time the above events are happening, governments around the world will be in the least position to help. They are broke, they set expectations of some sort of fountain of youth money supply, and there ability to solve and manage the big problems. All of that will be laid bare in the coming decade. We are on our own, at best, and with an increasingly hostile, and parnoid government out for its own survival, at worst.

Ready to kill yourself yet? LOL, sounds bad, and it is, but you must know the important problems, in order to solve them. Remember:

HE WHO PANICS FIRST WINS!

and

TO THE PREPARED GOES THE PROFITS!

I will have much more to say about this in the coming months, but this is what you should start to think about now, in order to profit and survive.

- China, Russia, Europe,Canada, and Japan will be failed societies, think about getting out.

- Southeast Asia, maybe Australia, maybe Northern California, South Central U.S, North Central Mexico, and Argentina likely OK. India and Pakistan are wild cards depending on their ability to manage the volatility.

- Get out of the cities, You will be trapped.

- Get as energy and food independent, as possible. Be prepared to grow food under glass, depending where you are living. Solar and wind, a must.

- Buy the Agriculture, Coal, ETF's, and the best Natural Gas names once the bankruptcy waves subside.

- For your children, or yourself if you are young enough, Food technology, Geneticists, Biochemistry, Civil Engineering, Biomedical Engineering, Water Technology, and Robotics. Forget everything else. A starving and aging world does not need Pysch majors.

I hope I got your attention. Now do something about it.

Wednesday, February 24, 2016

Buy Low, Sell High

While we are enjoying low soybean prices, keep in mind this chart. We can expect a strong reversion of the El Nino event and that means CORN, WEAT, and SOYB are bargains here.

For perspective Soybeans doubled during the last LaNina, and this one will be 1.5 times stronger.

Buy low, sell high.

I already started tracking them, primarily through DBA. Sign up for my signals and I will let you know when to buy, add, reduce, and sell these stocks. Your family's to thrive is at stake.

For perspective Soybeans doubled during the last LaNina, and this one will be 1.5 times stronger.

Buy low, sell high.

I already started tracking them, primarily through DBA. Sign up for my signals and I will let you know when to buy, add, reduce, and sell these stocks. Your family's to thrive is at stake.

Tuesday, February 23, 2016

President Obama's Baby

The President takes great pride in Saving Detroit. He did it by allowing anyone with a pulse to buy a car on Credit. They are now defaulting in great numbers, and is close to the 2008 levels. When this door closes, the economy will suffer some serious losses.

Monday, February 22, 2016

A Decision Has Been Made

It sure apears that front running the Fed's March meeting is the play. for me that means I drop my short positions, take the loss and go long high beta (LABU), and oil (UWTI). I will also buy some DUST as risk on means slam gold.

I will continue to monitor DAG, as well. I will post entries and stops for my subscribers via Twitter.

I will continue to monitor DAG, as well. I will post entries and stops for my subscribers via Twitter.

Sunday, February 21, 2016

Hard Resistance?

Last week was a tough one for me. My father passed away and they live 3000 miles away. So I was distracted from the markets a bit. But I am now back.

I went short on Tuesday day, after riding the reversal for three days. I left those trades on, those being SDS, TVIX, and SRS. The week after OPEX is usually weak.

Strategically:

Two things are going to happen; either we (the market) decides to front run the Federal Reserve anticipating them folding and blast through 195, or force the Fed to fold by driving the market lower than 181.

I think a case can be made in either direction.

The short case says 194/5 can't be broken even with driving the most shorted to cover, oil shorts to cover, and vol longs to sell. The Yen is breaking higher again, as well.

On the long side, Biotech is firming up, as well as Gold and the miners suggesting major liquidity is forthcoming.

Monday's have been red of late, and if so I will set stops on my shorts, if Green I will take my losses and wait for a better setup and go long LABU.

I am also interested in taking another run at DUST

I added DAG to my watch-list as I think food prices will run with any new liquidity injected into the markets.

I went short on Tuesday day, after riding the reversal for three days. I left those trades on, those being SDS, TVIX, and SRS. The week after OPEX is usually weak.

Strategically:

Two things are going to happen; either we (the market) decides to front run the Federal Reserve anticipating them folding and blast through 195, or force the Fed to fold by driving the market lower than 181.

I think a case can be made in either direction.

The short case says 194/5 can't be broken even with driving the most shorted to cover, oil shorts to cover, and vol longs to sell. The Yen is breaking higher again, as well.

On the long side, Biotech is firming up, as well as Gold and the miners suggesting major liquidity is forthcoming.

Monday's have been red of late, and if so I will set stops on my shorts, if Green I will take my losses and wait for a better setup and go long LABU.

I am also interested in taking another run at DUST

I added DAG to my watch-list as I think food prices will run with any new liquidity injected into the markets.

Monday, February 15, 2016

Reversal in Process

After Thursday's hard push down was rejected, we rallied Friday over the hourly 22 EMA, which also happened to flip positive slope. This tells me to respect a reversal. We caught the reversal with a short vol and a long Biotech trade, and are still holding. We'll see where this peters out.

I expect there will be a raid on gold and silver, and I had a sell signal that was rejected Friday for no gain/loss, but will reenter short if it sets up again. I m bullish on the PM's but that move was too far and too fast and tempting for the robots to short.

The signals are just killing it. No drama, real time buy and sell signals tweeted, and in many cases buy and sell limits/stops given. I follow 8 categories of ETF's, long/short, non leveraged and ultra Something for everyone, and at $12.50/month it is a bargain. I offer this price, as a service as most paid sites are garbage at 8 times the price. It gives me enough income to focus on you and your trade setups.

Enjoy the week ahead.

I expect there will be a raid on gold and silver, and I had a sell signal that was rejected Friday for no gain/loss, but will reenter short if it sets up again. I m bullish on the PM's but that move was too far and too fast and tempting for the robots to short.

The signals are just killing it. No drama, real time buy and sell signals tweeted, and in many cases buy and sell limits/stops given. I follow 8 categories of ETF's, long/short, non leveraged and ultra Something for everyone, and at $12.50/month it is a bargain. I offer this price, as a service as most paid sites are garbage at 8 times the price. It gives me enough income to focus on you and your trade setups.

Enjoy the week ahead.

Wednesday, February 10, 2016

Just Waiting on Yellen

We are having our predictable push into the Humprey Hawkin meetings. Unless she is explicit on easing we will continue the trend down. For now, pretty light, short the Energy producers and temporarily short GDX. I am looking to short IWM and SPY soon. Likely to use SDS, TVIX, and TWM as the vehicles.

Also, as I was under the weather and super bowl last weekend, I did not update my results. They are below.

Also, as I was under the weather and super bowl last weekend, I did not update my results. They are below.

Wednesday, February 3, 2016

We're Turning Japanese, I Really Think So

The second breakout attempt of 2016 has just failed. It failed at the 50% retrace line, and broke back below the 38% line. That is around the 191.50 area. That should prove difficult to move higher though on this go around. If 187.70 area fails we can expect a move back below 180 area.

The cause for alarm this time is Japan. Believe it or not the market did not think Japan went negative enough. Japan is in a deflationary collapse, and all of their efforts to reflate are not working. Essentially they are running out of ways to arbitrate the interest rate differentials, and when you go negative, it is like quantum physics, the rules change. Instead of forcing borrowing and credit creation which causes the inflation they want people and businesses simply leave the banking system and the country. That is a big problem for them, and the rest of the world as it drives deflation worldwide.

We now have the three largest trading nations/blocs, all exporters, with negative interest rates or rapidly devaluing their currencies, or both. This will crush the profit margins of our multi-nationals due to currency, and our domestic companies through price dumping into our shores.

Remember growth cannot separate from interest rates, and margins follow growth, and stock prices follow cash flow. All of this brought to you by the smartest people in the room. This will not end well. Cash, Gold, and Treasuries are the safe havens this year.

The cause for alarm this time is Japan. Believe it or not the market did not think Japan went negative enough. Japan is in a deflationary collapse, and all of their efforts to reflate are not working. Essentially they are running out of ways to arbitrate the interest rate differentials, and when you go negative, it is like quantum physics, the rules change. Instead of forcing borrowing and credit creation which causes the inflation they want people and businesses simply leave the banking system and the country. That is a big problem for them, and the rest of the world as it drives deflation worldwide.

We now have the three largest trading nations/blocs, all exporters, with negative interest rates or rapidly devaluing their currencies, or both. This will crush the profit margins of our multi-nationals due to currency, and our domestic companies through price dumping into our shores.

Remember growth cannot separate from interest rates, and margins follow growth, and stock prices follow cash flow. All of this brought to you by the smartest people in the room. This will not end well. Cash, Gold, and Treasuries are the safe havens this year.

Subscribe to:

Posts (Atom)